13/06/2016

Negative Gearing- the real economic problem.

13 June 2016

Negative gearing is seen as just an easy way to make money. You buy a property, gear it to lose money and get a tax deduction. The property goes up in value, and you make a fortune. In fact, the less you put in, the higher your percentage return. It is seen as impossible to lose as Australian real estate keeps rising. But it is a real danger to all of Australia. Here is why.

Firstly, the reason that you are most likely to hear is that there may be a housing bubble. In the US bubble, they sold houses to people who could not pay at all. In Oz, we can pay, but interest rates are at record lows, about 4%. If interest rates rise, there will be huge problems. If interest rose 2.5% households with the top 10 per cent of debt, would see their repayments rise from 37.3 per cent of their disposable income to 52.7 per cent. This would increase their annual interest repayments by $12,358, from $29,989 to $42,347 per year.

Many people could not pay if the rates rose to their historic levels, say 6-8%. That would be a big shock to the banks.

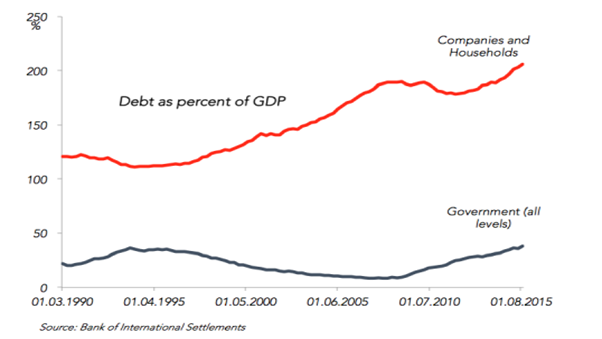

But the real problem is not discussed. The expectation that house prices will rise means that everyone borrows much more for real estate. Added to this the banks lend far more. If anyone asked to buy shares on 100% loan or even close no one would lend. But real estate- no problem. Thus the money that increases housing prices is all borrowed. Non-existent money, invented. The banks use the title documents and mortgage to lend more and more, and then pocket the interest from the previously non-existent money. If they are short, they borrow overseas. So Australia pays lots of extra debt money to foreign banks just so that we can increase our house prices. They are still the same houses. Australia’s private debt is now 123.08% of GDP, overtaking world debt leader Denmark at 122.99%. No other country is close in terms of having such extreme household sector debts. The UK ratio is 85.9% while in the US it is 79.1[i]%. So we cannot invest in our industry or our infrastructure because we are paying interest for speculative real estate. Those who are not speculating are simply paying because of the speculation, and suffer either by paying too much, or by being excluded altogether, an immediate social consequence of the speculative price bubble. Australia’s shortage of investment capital is made much worse because of our tax treatment that encourages real estate debt ahead of investment in productive assets that will give a return to the country. So we sell our farms, lease our ports to the Chinese, and get foreign companies to build our infrastructure. They will get a huge toll income from this infrastructure in the future- all money that will go overseas. We are losing control of our country because of the easy profits of real estate speculation. The Liberal government which takes an almost religious line that poor people have to have a hard time now for benefits in the future, are not willing to say no to negative gearing, which will have a far worse effect on our future. The donations from the property sector and banks, who profit from all this have added to their party coffers to blind them further to this reality.

More political courage and honesty is needed. Better try the Greens!

[1] Soos P. How Australian households became the most indebted in the world. Guardian 16/1/16